News & Updates

LEIBOVIT VR NEWSLETTERS - 'TURNAROUND TUESDAY' - APRIL 23, 2024 - SHORTENED LETTER FOR PASSOVER THIS WEEK

What Is Passover (Pesach)?

Passover 2024 will be celebrated from April 22-30

https://www.chabad.org/holidays/passover/pesach_cdo/aid/871715/jewish/What-Is-Passover-Pesach.htm

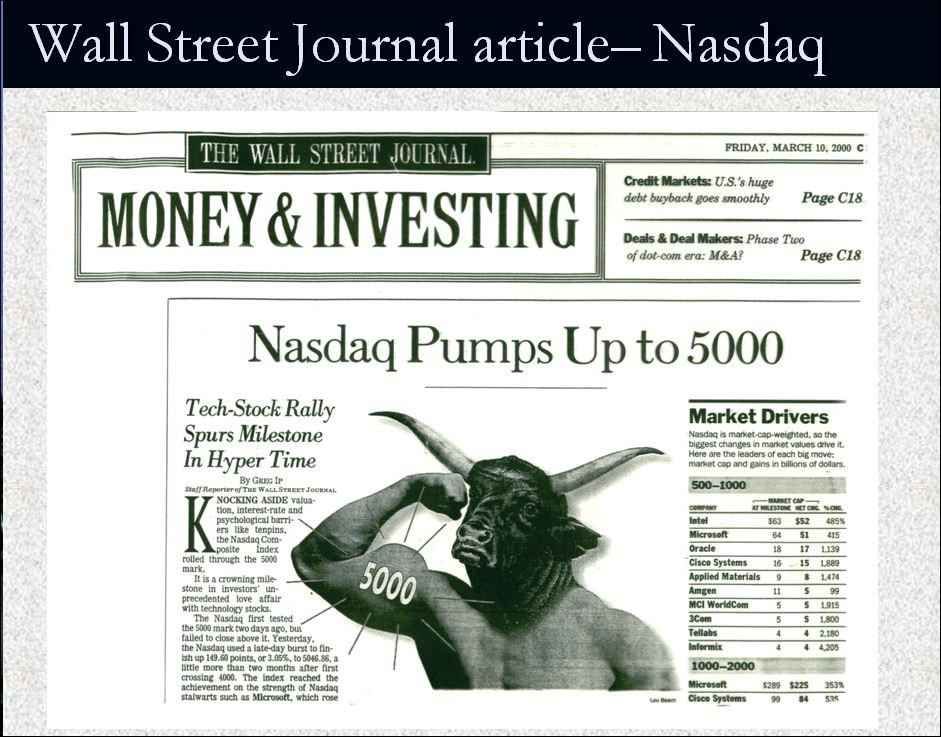

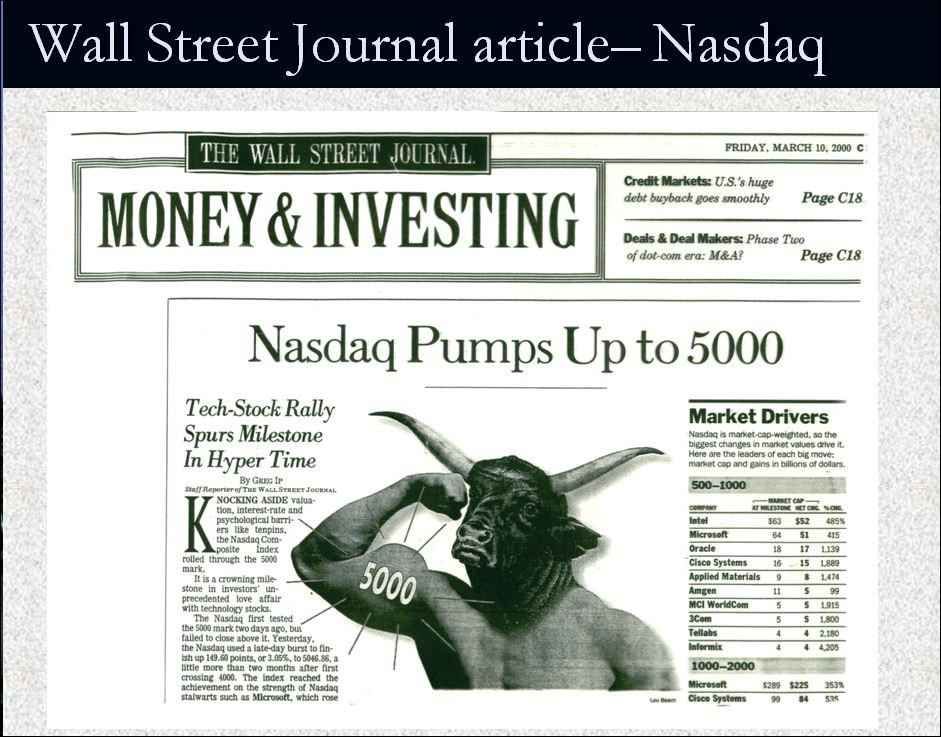

FOLKS THIS ALL YOU NEEDED TO KNOW! HISTORICALLY A GOOD SIGN THAT WE ARE AT OR NEAR A MARKET TOP = BULLISH MEDIA HEADLINES LIKE THIS. RECALL THE MARCH 10, 2000 TOP HEADLINE IN THE WALL STREET JOURNAL (BELOW) RIGHT AT THE TOP!

I CALL CORRECTLY CALLED A BULL TRAP. WHERE IS CNBC, FOX NEWS, THE WALL STREET JOURNAL ACKNOWLEDGING MY CALL?

WHAT ABOUT MY CALL FOR BLACK SWANS. WE'VE SEEN A FEW. ARE MORE BLACK SWANS ARE UNDERWAY ? - CAN YOU NAME THE ONES WE'VE JUST RECENTLY EXPERIENCED? CAN YOU GUESS WHAT COULD BE COMING. AGAIN, NO RECOGNITION IN THE FINANCIAL MEDIA. THEY ARE TOO EMBARRASSED.

THE VR FORECASTER - ANNUAL FORECAST MODEL

ORDER TODAY AND WE WILL MANUALLY EMAIL YOU THE REPORT BEFORE IT IS POSTED ON THE WEBSITE

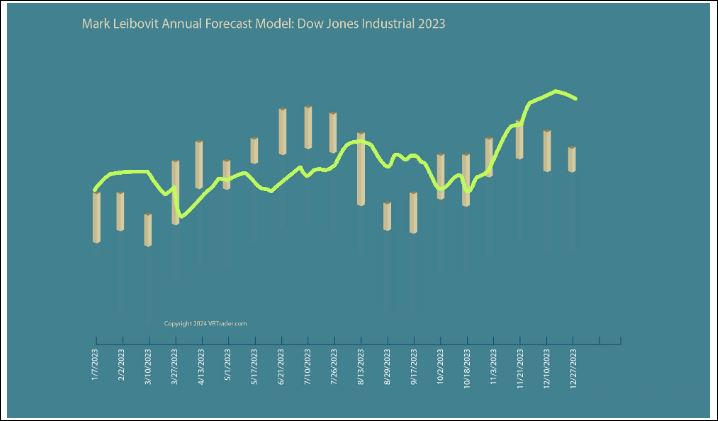

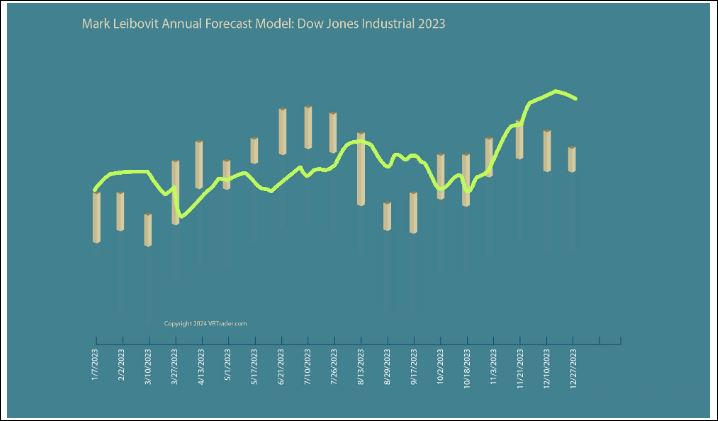

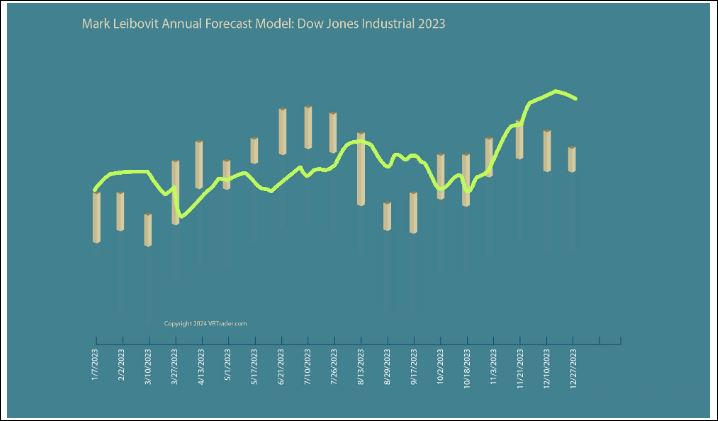

HERE IS THE 2023 ANNUAL FORECAST MODEL WITH THE 'RESULTS' SUPERIMPOSED

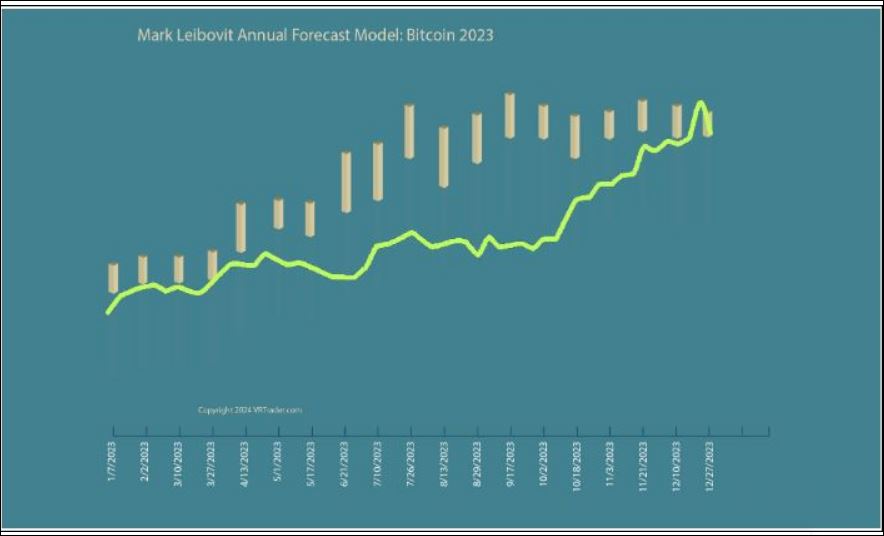

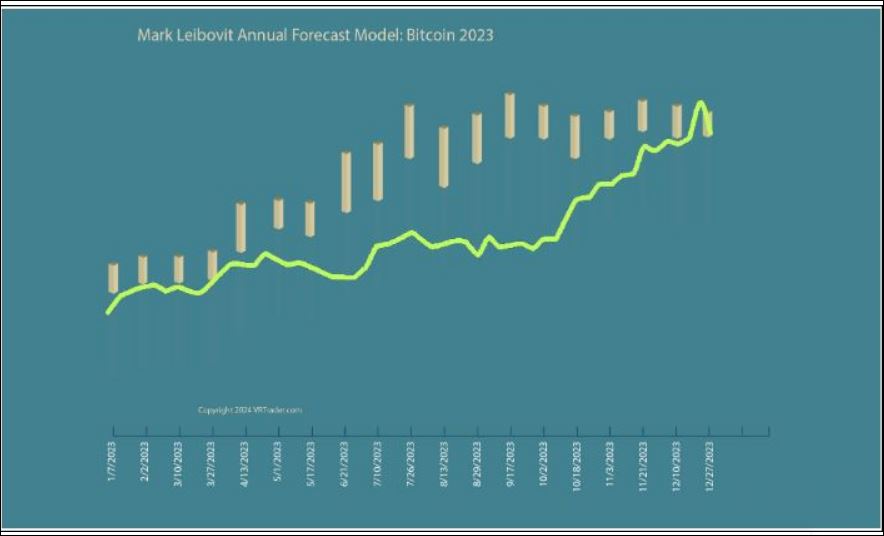

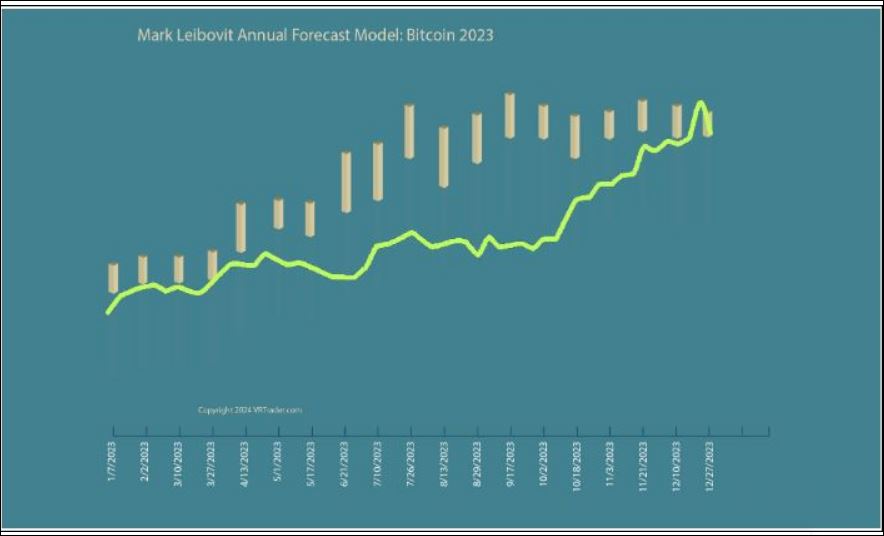

HERE IS THE 2023 ANNUAL FORECAST MODEL FOR BITCOIN WITH THE 'RESULTS' SUPERIMPOSED

ORDER PAGE

http://tinyurl.com/5f7wb6zs

https://www.howestreet.com/2024/04/stock-markets-appear-to-be-in-correction-territory-mark-leibovit/

WHO IS MARK LEIBOVIT?

MARK LEIBOVIT is Chief Market Strategist for LEIBOVIT VR NEWSLETTERS a/k/a VRTrader.Com. His technical expertise is in overall market timing and stock selection based upon his proprietary VOLUME REVERSAL (TM) methodology and Annual Forecast Model.

Mark's extensive media television profile includes seven years as a consultant ‘Elf’ on “Louis Rukeyser’s Wall Street Week” television program, and over thirty years as a Market Monitor guest for PBS “The Nightly Business Report”. He also has appeared on Fox Business News, CNBC, BNN (Canada), and Bloomberg, and has been interviewed in Barrons, Business Week, Forbes and The Wall Street Journal and Michael Campbell's MoneyTalks.

In the January 2, 2020 edition of TIMER DIGEST MAGAZINE, Mark Leibovit was ranked the #1 U.S. Stock Market Timer and was previously ranked #1 Intermediate U.S. Market Timer for the ten year period December, 1997 to 2007.

He was a 'Market Maker' on the Chicago Board Options Exchange and the Midwest Options Exchange and then went on to work in the Research department of two Chicago based brokerage firms. Mr. Leibovit now publishes a series of newsletters at www.LeibovitVRNewsletters.com. He became a member of the Market Technicians Association in 1982.

Mr. Leibovit’s specialty is Volume Analysis and his proprietary Leibovit Volume Reversal Indicator is well known for forecasting accurate signals of trend direction and reversals in the equity, metals and futures markets. He has historical experience recognizing, bull and bear markets and signaling alerts prior to market crashes. His indicator is currently available on the Metastock platform.

His comprehensive study on Volume Analysis, The Trader’s Book of Volume published by McGraw-Hill is a definitive guide to volume trading. It is now also published in Chinese. Mark has appeared in speaking engagements and seminars in the U.S. and Canada.

U.S. Stocks Close On Bright Note Despite Coming Off Day's Highs

U.S. stocks climbed higher on Monday with those from the technology sector turning in a fine performance, as traders

indulged in some bargain hunting after recent losses. Easing worries about Middle East tensions helped underpin sentiment.

The major averages all closed on a firm note. The Dow ended with a gain of 253.78 points or 0.67 percent at 38,239.98,

more than 200 points off the day's high of 38,447.16. The S&P 500, which climbed to 5,038.84, settled at 5,010.60, gaining

43.37 points or 0.87 percent, while the Nasdaq ended higher by 169.30 points or 1.11 percent at 15,451.31, off the day's

high of 15,539.00.

The market gained amid slightly easing fears of a wider Middle East conflict after Iran and Israel completed 'measured'

counterattacks that were calibrated to avoid any casualties. A bit of bargain hunting is contributing as well to the

market's rise.

Investors awaited a slew of key U.S. economic data this week, including reports on new home sales, durable goods orders

and personal income and spending.

The Commerce Department's personal income and spending report includes readings on inflation said to be preferred by the

Federal Reserve.

Earnings season also starts to pick up steam this week, with Tesla (TSLA), Boeing (BA), IBM (IBM), Caterpillar (CAT),

Honeywell (HON), Alphabet (GOOGL), Intel (INTC), Microsoft (MSFT), Chevron (CVX) and Exxon Mobil (XOM) among the companies

due to report their quarterly results.

Goldman Sachs and JPMorgan Chase climbed 3.3% percent and about 2%, respectively. Procter & Gamble gained 1.5 percent.

Amazon, McDonald, Chevron, Amgen and Walmart gained 1 to 1.5 percent.

Salesforce.com shares gained more than 1 percent after the company backed away from its talks to acquire data-management

software firm Informatica.

Ford Motor rallied more than 6 percent. United Airlines Holdings gained about 5 percent. Nvidia climbed 4.35 percent.

Citigroup, Delta Airlines, Seagate Technology, Moderna and American Airlines also ended sharply higher.

Verizon ended 4.7 percent down. The company, which announced weak profit and slightly higher revenues in its first

quarter, maintained its fiscal 2024 earnings outlook. For 2024, Verizon continues to expect adjusted earnings per share of

$4.50 to $4.70.

Tesla drifted down 3.4 percent, on concerns over gross margins after the company lowered prices in several markets.

In overseas trading, stock markets across the Asia-Pacific region moved mostly higher during trading on Monday. Japan's

Nikkei 225 Index jumped by 1.0 percent, while Hong Kong's Hang Seng Index surged by 1.8 percent.

The major European markets also moved to the upside on the day. While the U.K.'s FTSE 100 Index shot up by 1.62 percent,

the German DAX Index climbed 0.7 percent and the French CAC 40 Index ended up by 0.22 percent.

In commodities trading, crude oil futures ended down $0.29 at $82.35 a barrel. Gold futures dropped $66.20 or about 2.76

percent, to $2,332.20 an ounce.

On the currency front, the U.S. dollar was up at 154.84 yen versus the 154.64 yen it fetched at the close of New Yourk

trading on Friday. Against the euro, the dollar was at 1.0655, compared to last Friday's $1.0656.

Fed says 1,804 banks and other institutions tapped emergency lending facility -Yahoo! Finance

(Reuters) - Some 1,804 depository institutions tapped the emergency lending facility set up last March in the wake of Silicon Valley Bank's collapse, amounting to about 20% of all eligible firms, the Federal Reserve said on Friday.

About 95% of the borrowers, which included banks, credit unions, savings associations, and branches and agencies of foreign banks, had less than $10 billion in assets, the U.S. central bank said in its semi-annual Financial Stability Report.

The Bank Term Funding Program, as it was called, was aimed at addressing a liquidity crunch after a run on deposits led to the failures of SVB and Signature Bank and forced financial authorities to stage a rescue of the sector.

The facility lent on collateral without applying the usual haircuts and the loans were made on cheap terms.

The program stopped making new loans on March 11, a year after its creation. At its peak it extended a total of $165 billion in loans, with terms of up to a year. It is expected to close down completely by next March.

Former Democrat Comes Out Against the Democratic Agenda

Vince Everett Ellison:

The Democratic party is evilest organization in the history of the world and is presently being controlled by cabala perverts, liars, psychopaths and anti-christian bigots

https://www.armstrongeconomics.com/international-news/politics/former-democrat-comes-out-against-the-democratic-agenda/

The Significance of the Month of April

Courtesy Bill Koenig (watch.org)

· Major wars began in the U.S. in this time frame.

· Major domestic terror events occurred numerous times on April 19.

· Mohammed and Hitler were both born on April 20.

· From 2006 to 2013, and once again in 2014 (and now again in 2024), there were major news items about Iran in April.

The Natural Year

· The sun governs our seasons, which are measured by the solstices and equinoxes. By many accounts, the natural year begins with the vernal equinox on March 20/21. This has been true in agrarian (agriculture/ farming-based) societies for thousands of years. It has also been true in civilizations that worshipped the sun (and established their calendars accordingly).

· As such, it starts the clock on the “opening range” of each natural year.

· If one were to begin a calendar on the vernal equinox (start of spring), the first month of that year would end on April 19/20. It is when the northern half of the earth transitions from seasonal “death” to “life.” In the old days, it was also when “kings went off to war.” (See the biblical account of when David chose not to go off.)

· Anyone who suffers from seasonal affective disorder (SAD) could certainly attest to the psychological aspects of longer days and more sunlight when the shroud of depression lifts and the rays of hope come flooding back into their lives.

· This period — from March 20/21 to April 19/20 — marks a very important transition period, linked to various means of measuring time with physical (natural), celestial (astronomy), metaphysical (astrology) and supernatural (Jewish and Christian commemorations) implications.

· April 19/20 acts like a deadline for determining what to expect in the coming (natural) year. It is a time to watch each year for signs of “change.”

———

Date of infamy for America — April 19 and the days around it

· This “natural year opening range” has diverse — and, seemingly, contradictory —implications. As just explained, it is a time when much of nature comes back to life.

· Paradoxically, it is when man often incites war (and the end of many lives). Nowhere has this remained more constant than in the histories of America and Israel.

· I have explained this concept many times before, but it is also the single most requested compilation of analysis from readers.

· In short, Eric Hadik has termed the date of April 19 (sometimes extending to the days surrounding it) as the “date of infamy” for America.

· Historically, many events that occurred during April 19-20 set the stage for the rest of the year …

———

The following are just a few of the events that have occurred on this date and have impacted/governed America's destiny … beginning with our independence (and incorporating almost every major, decisive war in our history):

· Start of Revolutionary War—April 19, 1775

· Battle of San Jacinto/end of Texas Revolution—April 19-21, 1836

· Start of Mexican-American War—April 25, 1846

· Start of Civil War—April 12, 1861

· Start of Spanish-American War—April 26, 1898

· President Franklin D. Roosevelt announces U.S. will leave gold standard—April 19, 1933

· Bay of Pigs invasion failure—April 17-19, 1961

· End of Vietnam War—April 30, 1975

· Operation Praying Mantis was on April 18, 1988. It was an attack by U.S. naval forces in retaliation for the Iranian mining of the Persian Gulf and the subsequent damage to an American warship. This battle was the largest of five major U.S. surface engagements since the Second World War.

———

The April 19/20 date has pinpointed many events of great ‘civil unrest’ and/or domestic terrorism in the U.S. They include:

· ATF raid on Covenant of the Sword and the Arm of the Lord (CSA)—April 19-21, 1985 (linked to the Oklahoma City bombing a decade later)

· Explosion on the USS Iowa (speculated to be an act of sabotage/suicide, but never proven)—April 19, 1989

· Waco/Branch Davidian raid by FBI/ATF—April 19, 1993

· Oklahoma City Bombing—April 19, 1995

· Columbine High School massacre—April 20, 1999

Additional events:

· Anti-Jewish riots break out in Palestine—April 19, 1936

· USSR performs nuclear test at Semipalitinsk, Eastern Kazakhstan, USSR—April 19, 1985

· Benedict XVI, Cardinal Joseph Ratzinger, becomes the 265th pope—April 19, 2005

· Massive BP Petroleum oil spill in the Gulf of Mexico, began on April 20, 2010

The historical date of infamy for Israel and her enemies – April 20/21

This date has also had a dramatic impact on Israel and Jews. In the last 2,000 years, Jews have had many enemies and many antagonists; but three, in particular, stand out:

· Birth of Rome/Roman Empire

· Islam/Mohammad

· Nazi Germany/Hitler

What do they have in common? They were all born on April 20/21.

· The birth of Rome (by Romulus) is dated as April 21, 753 B.C.

· The birth of Mohammad is dated as April 20, 571 A.D.

· The birth of Adolph Hitler was April 20, 1889.

Additional:

· Israel faced the Great Arab Revolt of April 19, 1936.

· The birth of Iranian Supreme Leader Ali Khamenei on April 19, 1939.

· The Warsaw Ghetto Uprising began April 19, 1943.

· The ascension of Gamal Abdel Nasser in Egypt on April 18, 1954. Nasser was Israel’s lead antagonist for almost two decades. He was responsible for three wars with Israel from 1956–1970. He was also responsible for the first United Arab Republic—in 1958–1961, a concept that could reach a more cohesive realization in the coming years.

To say the least, this has been a very significant period of time for centuries.

The President's Working Group on Financial Markets

known colloquially as the Plunge Protection Team, or "(PPT)" was created by Executive Order 12631,[1] signed on March 18, 1988, by United States President Ronald Reagan.

As established by the executive order, the Working Group has three purposes and functions:

"(a) Recognizing the goals of enhancing the integrity, efficiency, orderliness, and competitiveness of our Nation's financial markets and maintaining investor confidence, the Working Group shall identify and consider:

(1) the major issues raised by the numerous studies on the events in the financial markets surrounding October 19, 1987, and any of those recommendations that have the potential to achieve the goals noted above; and

(2) the actions, including governmental actions under existing laws and regulations (such as policy coordination and contingency planning), that are appropriate to carry out these recommendations.

(b) The Working Group shall consult, as appropriate, with representatives of the various exchanges, clearinghouses, self-regulatory bodies, and with major market participants to determine private sector solutions wherever possible.

(c) The Working Group shall report to the President initially within 60 days (and periodically thereafter) on its progress and, if appropriate, its views on any recommended legislative changes."

Plunge Protection Team

"Plunge Protection Team" was originally the headline for an article in The Washington Post on February 23, 1997, and has since been used by some as an informal term to refer to the Working Group. Initially, the term was used to express the opinion that the Working Group was being used to prop up the stock markets during downturns.[5 Financial writers for British newspapers The Observer and The Daily Telegraph, along with U.S. Congressman Ron Paul, writers Kevin Phillips (who claims "no personal firsthand knowledge" and John Crudele,[8] have charged the Working Group with going beyond their legal mandate.[failed verification] Charles Biderman, head of TrimTabs Investment Research, which tracks money flow in the equities market, suspected that following the 2008 financial crisis the Federal Reserve or U.S. government was supporting the stock market. He stated that "If the money to boost stock prices did not come from the traditional players, it had to have come from somewhere else" and "Why not support the stock market as well? Moreover, several officials have suggested the government should support stock prices."

In August 2005, Sprott Asset Management released a report that argued that there is little doubt that the PPT intervened to protect the stock market.[10] However, these articles usually refer to the Working Group using moral suasion to attempt to convince banks to buy stock index futures.

Former Federal Reserve Board member Robert Heller, in the Wall Street Journal, opined that "Instead of flooding the entire economy with liquidity, and thereby increasing the danger of inflation, the Fed could support the stock market directly by buying market averages in the futures market, thereby stabilizing the market as a whole." Author Kevin Phillips wrote in his 2008 book Bad Money that while he had no interest "in becoming a conspiracy investigator", he nevertheless drew the conclusion that "some kind of high-level decision seems to have been reached in Washington to loosely institutionalize a rescue mechanism for the stock market akin to that pursued...to safeguard major U.S. banks from exposure to domestic and foreign loan and currency crises." Phillips infers that the simplest way for the Working Group to intervene in market plunges would be through buying stock market index futures contracts, either in cooperation with major banks or through trading desks at the U.S. Treasury or Federal Reserve.

What is the Plunge Protection Team?

(PPT) is an informal term for the Working Group on Financial Markets. The working group was created in 1988 by then U.S President Ronald Reagan following the infamous October 1987 Black Monday crash. It was formed to re-establish consumer confidence and take steps to achieve economic and market stability in the aftermath of the market crash. The U.S president consults with the team during times of economic uncertainty and turbulence in the markets.

The Working Group on Financial Markets’ informal name “Plunge Protection Team” was coined and popularized by The Washington Post in 1997.

What does the Plunge Protection Team Do?

The Plunge Protection Team was initially formed to advise the president and regulatory agencies on countering the negative impacts of the stock market crash of 1987. However, the team has continued to report to various presidents since that stock market crash and has met various U.S presidents on important financial matters over the years.

The team was believed to be behind the rally in the stock market shortly after a hefty drop in the Dow Jones Industrial Average (DJIA) on February 05, 2018. As per some market observers, after the plunge, the market made a smart recovery in the following days, which may have been a result of heavy buying by the Plunge Protection Team.

Who is on the plunge protection team?

The PPT several top government economic and financial officials. The Secretary of the Treasury heads the group, while the Chair of the Board of Governors of the Federal Reserve, the Chair of the Commodity Futures Trading Commission, and the Chair of the Securities and Exchange Commission, are also part of the team.

Why is the PPT secretive?

The Plunge Protection Team’s meetings or activities aren’t covered by the media, which gives rise to speculations and conspiracy theories about the team. The probable reason behind the secretive nature of its activities is that it reports only to the president. Some observers opine that the team’s role is not only limited to giving recommendations to the president; rather, the team intervenes in the market and artificially props up stock prices.

Critics claim that the members connive with big banks and profit from stock markets by carrying out trades on different stock exchanges when prices decline. They then artificially prop up the prices as part of their market stabilization efforts and profit from their transactions.

When does/have the PPT meet?

Although very little has come out in the mainstream media about the group’s activities, there have been some instances when the team’s meetings were reported. For example, in 1999, the team proposed to congress to incorporate some changes in the derivatives markets regulations. The last reported meeting of the group, at the time of this writing in June 2022, was in December 2018 when Treasury Secretary Steven Mnuchin headed the teleconference with the group’s members. Representatives from the Federal Deposit Insurance Corporation and the Comptroller of the Currency also attended the meeting.

Before the teleconference that took place on December 24, 2018, the S&P 500 and the DJIA had been under pressure for the whole month. But after Christmas, the DJIA and the S&P 500 both recovered and reversed most of the losses in the next few days. Conspiracy theorists attribute the recovery and gains in the indices to the intervention by the Plunge Protection Team.

Final Thoughts

The Working Group on Financial Markets serves an important function: to advise the president on financial markets and economic affairs. Because the exact nature of the group’s activities or recommendations haven't been made public, some critics of the group blame the group for market intervention and artificially propping up stocks’ prices. However, some market observers believe that the team’s quiet activities are excused as it reports directly to the president.

The Exchange Stabilization Fund protects the FED.

We already know the FED is lying that raising interest rates will reduce price inflation. The Exchange Stabilization Fund (ESF) is an emergency reserve account that can be used by the U.S. Department of Treasury to mitigate instability in various financial sectors, including credit, securities, and foreign exchange markets. The U.S. Exchange Stabilization Fund was established at the Treasury Department by a provision in the Gold Reserve Act of 1934.

https://en.wikipedia.org/wiki/

Gold market manipulation: Why, how, and how long? (2021 edition)

https://gata.org/node/20925

https://tinyurl.com/2rd9wv52

OPPORTUNITY TO ACCESS MARK LEIBOVIT'S PROPRIETARY VOLUME REVERSAL INDICATOR - THIS IS THE ONLY PLACE TO DO IT!

https://www.metastock.com/prod

COME ON, DAD. IT'S TIME TO EAT

DISCLAIMER:

WE ARE NOT FINANCIAL ADVISORS AND DO NOT PROVIDE FINANCIAL ADVICE

The website, LeibovitVRNewsletters.com, is published by LeibovitVRNewsletters LLC.

In using LeibovitVRnewsletters.com (a/k/a LeibovitVRNewsletters LLC) you agree to these Terms & Conditions governing the use of the service. These Terms & Conditions are subject to change without notice. We are publishers and are not registered as a broker-dealer or investment adviser either with the U.S. Securities and Exchange Commission or with any state securities authority.

All stocks and ETFs discussed are HYPOTHETICAL and not actual trades whose actual execution may differ markedly from prices posted on the website and in emails. This may be due internet connectivity, quote delays, data entry errors and other market conditions. Hypothetical or simulated performance results have certain inherent limitations as to liquidity and execution among other variables. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE FORECASTING ACCURACY OR PROFITABLE TRADING RESULTS.

All investments are subject to risk, which should be considered on an individual basis before making any investment decision. We are not responsible for errors and omissions. These publications are intended solely for information and educational purposes only and the content within is not to be construed, under any circumstances, as an offer to buy or to sell or a solicitation to buy or sell or trade in any commodities or securities named within.

All commentary is provided for educational purposes only. This material is based upon information we consider reliable. However, accuracy is not guaranteed. Subscribers should always do their own investigation before investing in any security. Furthermore, you cannot be assured that your will profit or that any losses can or will be limited. It is important to know that no guarantee of any kind is implied nor possible where projections of future conditions in the markets are attempted.

Stocks and ETFs may be held by principals of LeibovitVRNewsletters LLC whose personal investment decisions including entry and exit points may differ from guidelines posted.

LeibovitVRNewsletters.com cannot and do not assess, verify or guarantee the suitability or profitability of any particular investment. You bear responsibility for your own investment research and decisions and should seek the advice of a qualified securities professional before making any investment. As an express condition of using this service and anytime after ending the service, you agree not to hold LeibovitVRNewsletters.com or any employees liable for trading losses, lost profits or other damages resulting from your use of information on the Site in any form (Web-based, email-based, or downloadable software), and you agree to indemnify and hold LeibovitVRNewsletters.com and its employees harmless from and against any and all claims, losses, liabilities, costs, and expenses (including but not limited to attorneys' fees) arising from your violation of this agreement. This paragraph is not intended to limit rights available to you or to us that may be available under the federal securities laws.

For rights, permissions, subscription and customer service, contact the publisher at mark.vrtrader@gmail.com or call at 928-282-1275 or mail to 10632 N. Scottsdale Road B-426, Scottsdale, AZ 85254.

The Leibovit Volume Reversal, Volume Reversal and Leibovit VR are registered trademarks.

© Copyright 2024. All rights reserved.

MARK LEIBOVIT - HIS NEWSLETTERS - MONDAY - APRIL 22, 2024 - PASSOVER WEEK BEGINS - TAKING SOME TIME OFF - BULLETINS EXCEPTED

What Is Passover (Pesach)?

Passover 2024 will be celebrated from April 22-30

https://www.chabad.org/holidays/passover/pesach_cdo/aid/871715/jewish/What-Is-Passover-Pesach.htm

FOLKS THIS ALL YOU NEEDED TO KNOW! HISTORICALLY A GOOD SIGN THAT WE ARE AT OR NEAR A MARKET TOP = BULLISH MEDIA HEADLINES LIKE THIS. RECALL THE MARCH 10, 2000 TOP HEADLINE IN THE WALL STREET JOURNAL (BELOW) RIGHT AT THE TOP!

I CALL CORRECTLY CALLED A BULL TRAP. WHERE IS CNBC, FOX NEWS, THE WALL STREET JOURNAL ACKNOWLEDGING MY CALL?

WHAT ABOUT MY CALL FOR BLACK SWANS. WE'VE SEEN A FEW. ARE MORE BLACK SWANS ARE UNDERWAY ? - CAN YOU NAME THE ONES WE'VE JUST RECENTLY EXPERIENCED? CAN YOU GUESS WHAT COULD BE COMING. AGAIN, NO RECOGNITION IN THE FINANCIAL MEDIA. THEY ARE TOO EMBARRASSED.

THE VR FORECASTER - ANNUAL FORECAST MODEL

ORDER TODAY AND WE WILL MANUALLY EMAIL YOU THE REPORT BEFORE IT IS POSTED ON THE WEBSITE

HERE IS THE 2023 ANNUAL FORECAST MODEL WITH THE 'RESULTS' SUPERIMPOSED

HERE IS THE 2023 ANNUAL FORECAST MODEL FOR BITCOIN WITH THE 'RESULTS' SUPERIMPOSED

ORDER PAGE

http://tinyurl.com/5f7wb6zs

https://www.howestreet.com/2024/04/stock-markets-appear-to-be-in-correction-territory-mark-leibovit/

WHO IS MARK LEIBOVIT?

MARK LEIBOVIT is Chief Market Strategist for LEIBOVIT VR NEWSLETTERS a/k/a VRTrader.Com. His technical expertise is in overall market timing and stock selection based upon his proprietary VOLUME REVERSAL (TM) methodology and Annual Forecast Model.

Mark's extensive media television profile includes seven years as a consultant ‘Elf’ on “Louis Rukeyser’s Wall Street Week” television program, and over thirty years as a Market Monitor guest for PBS “The Nightly Business Report”. He also has appeared on Fox Business News, CNBC, BNN (Canada), and Bloomberg, and has been interviewed in Barrons, Business Week, Forbes and The Wall Street Journal and Michael Campbell's MoneyTalks.

In the January 2, 2020 edition of TIMER DIGEST MAGAZINE, Mark Leibovit was ranked the #1 U.S. Stock Market Timer and was previously ranked #1 Intermediate U.S. Market Timer for the ten year period December, 1997 to 2007.

He was a 'Market Maker' on the Chicago Board Options Exchange and the Midwest Options Exchange and then went on to work in the Research department of two Chicago based brokerage firms. Mr. Leibovit now publishes a series of newsletters at www.LeibovitVRNewsletters.com. He became a member of the Market Technicians Association in 1982.

Mr. Leibovit’s specialty is Volume Analysis and his proprietary Leibovit Volume Reversal Indicator is well known for forecasting accurate signals of trend direction and reversals in the equity, metals and futures markets. He has historical experience recognizing, bull and bear markets and signaling alerts prior to market crashes. His indicator is currently available on the Metastock platform.

His comprehensive study on Volume Analysis, The Trader’s Book of Volume published by McGraw-Hill is a definitive guide to volume trading. It is now also published in Chinese. Mark has appeared in speaking engagements and seminars in the U.S. and Canada.

Nasdaq, S&P 500 Extend Losing Streaks On Tech Weakness But Dow Advances

With technology stocks under pressure, the Nasdaq showed a substantial move to the downside during trading on Friday, extending its recent losing streak. The S&P 500 also saw further downside, while the narrower Dow bucked the downtrend.

The Nasdaq plunged 319.49 points or 2.1 percent to 15,282.01, closing lower for the sixth straight session and tumbling to its lowest closing level in well over two months.

The S&P 500 also closed lower for the sixth straight day, slumping 43.89 points or 0.9 percent to a two-month closing low of 4,967.23.

Meanwhile, the Dow added to the slim gain posted in the previous session, climbing 211.02 points or 0.6 percent to 37,986.40.

For the week, the tech-heavy Nasdaq cratered by 5.5 percent and the S&P 500 dove by 3.1 percent, while the Dow crept slightly higher.

The steep drop by the Nasdaq partly reflected a nosedive by shares of Netflix (NFLX), with the streaming giant plunging by 9.1 percent.

Netflix came under pressure after reporting better than expected first quarter results but providing disappointing revenue guidance.

AI darling Nvidia (NVDA) also plummeted by 10.0 percent on the day, contributing to significant weakness in the semiconductor sector.

Reflecting the weakness in the sector, the Philadelphia Semiconductor Index dove by 4.1 percent to its lowest closing level since early February.

Considerable weakness among computer hardware stocks also weighed on the Nasdaq, with the NYSE Arca Computer Hardware Index tumbling by 3.7 percent to its lowest closing level in well over a month.

Outside of the tech sector, retail stocks also came under pressure on the day, dragging the Dow Jones U.S. Retail Index down by 1.5 percent.

Meanwhile, the Dow benefitted from a notable advance by shares of American Express, with the financial services giant surging by 6.2 percent.

The jump by American Express came after the company reported first quarter results that exceeded expectations on both the top and bottom lines.

Banking stocks also turned in a strong performance on the day, driving the KBW Bank Index up by 2.9 percent.

Interest rate-sensitive utilities stocks also moved notably higher amid a pullback by treasury yields, resulting in a 1.8 percent jump by the Dow Jones Utility Average.

An increase by the price of crude oil also contributed to strength among energy stocks after Israel launched retaliatory strikes against Iran.

Crude oil soared overnight but gave back ground after Iranian state media downplayed the attacks, saying explosions heard in Isfahan were a result of the activation of Iran's air defense systems.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region moved sharply lower during trading on Friday. Japan's Nikkei 225 Index plunged by 2.7 percent, while Hong Kong's Hang Seng Index slumped by 1.0 percent.

Meanwhile, the major European markets finished the day mixed. While the U.K.'s FTSE 100 Index crept up by 0.2 percent, the French CAC 40 Index closed just below the unchanged and the German DAX Index fell by 0.6 percent.

In the bond market, treasuries pulled back off their highs after an early advance but remained positive. As a result, the yield on the benchmark ten-year note, which moves opposite of its price, fell by 3.2 basis points to 4.615 percent after hitting a low of 4.582 percent.

Looking Ahead

Next week's trading may be impacted by reaction to the latest U.S. economic data, including reports on new home sales, durable goods orders and personal income and spending.

The Commerce Department's personal income and spending report includes readings on inflation said to be preferred by the Federal Reserve.

Earnings season also starts to pick up steam next week, with Tesla (TSLA), Boeing (BA), IBM (IBM), Caterpillar (CAT), Honeywell (HON), Alphabet (GOOGL), Intel (INTC), Microsoft (MSFT), Chevron (CVX) and Exxon Mobil (XOM) among the companies due to report their quarterly results.

The Significance of the Month of April

Courtesy Bill Koenig (watch.org)

· Major wars began in the U.S. in this time frame.

· Major domestic terror events occurred numerous times on April 19.

· Mohammed and Hitler were both born on April 20.

· From 2006 to 2013, and once again in 2014 (and now again in 2024), there were major news items about Iran in April.

The Natural Year

· The sun governs our seasons, which are measured by the solstices and equinoxes. By many accounts, the natural year begins with the vernal equinox on March 20/21. This has been true in agrarian (agriculture/ farming-based) societies for thousands of years. It has also been true in civilizations that worshipped the sun (and established their calendars accordingly).

· As such, it starts the clock on the “opening range” of each natural year.

· If one were to begin a calendar on the vernal equinox (start of spring), the first month of that year would end on April 19/20. It is when the northern half of the earth transitions from seasonal “death” to “life.” In the old days, it was also when “kings went off to war.” (See the biblical account of when David chose not to go off.)

· Anyone who suffers from seasonal affective disorder (SAD) could certainly attest to the psychological aspects of longer days and more sunlight when the shroud of depression lifts and the rays of hope come flooding back into their lives.

· This period — from March 20/21 to April 19/20 — marks a very important transition period, linked to various means of measuring time with physical (natural), celestial (astronomy), metaphysical (astrology) and supernatural (Jewish and Christian commemorations) implications.

· April 19/20 acts like a deadline for determining what to expect in the coming (natural) year. It is a time to watch each year for signs of “change.”

———

Date of infamy for America — April 19 and the days around it

· This “natural year opening range” has diverse — and, seemingly, contradictory —implications. As just explained, it is a time when much of nature comes back to life.

· Paradoxically, it is when man often incites war (and the end of many lives). Nowhere has this remained more constant than in the histories of America and Israel.

· I have explained this concept many times before, but it is also the single most requested compilation of analysis from readers.

· In short, Eric Hadik has termed the date of April 19 (sometimes extending to the days surrounding it) as the “date of infamy” for America.

· Historically, many events that occurred during April 19-20 set the stage for the rest of the year …

———

The following are just a few of the events that have occurred on this date and have impacted/governed America's destiny … beginning with our independence (and incorporating almost every major, decisive war in our history):

· Start of Revolutionary War—April 19, 1775

· Battle of San Jacinto/end of Texas Revolution—April 19-21, 1836

· Start of Mexican-American War—April 25, 1846

· Start of Civil War—April 12, 1861

· Start of Spanish-American War—April 26, 1898

· President Franklin D. Roosevelt announces U.S. will leave gold standard—April 19, 1933

· Bay of Pigs invasion failure—April 17-19, 1961

· End of Vietnam War—April 30, 1975

· Operation Praying Mantis was on April 18, 1988. It was an attack by U.S. naval forces in retaliation for the Iranian mining of the Persian Gulf and the subsequent damage to an American warship. This battle was the largest of five major U.S. surface engagements since the Second World War.

———

The April 19/20 date has pinpointed many events of great ‘civil unrest’ and/or domestic terrorism in the U.S. They include:

· ATF raid on Covenant of the Sword and the Arm of the Lord (CSA)—April 19-21, 1985 (linked to the Oklahoma City bombing a decade later)

· Explosion on the USS Iowa (speculated to be an act of sabotage/suicide, but never proven)—April 19, 1989

· Waco/Branch Davidian raid by FBI/ATF—April 19, 1993

· Oklahoma City Bombing—April 19, 1995

· Columbine High School massacre—April 20, 1999

Additional events:

· Anti-Jewish riots break out in Palestine—April 19, 1936

· USSR performs nuclear test at Semipalitinsk, Eastern Kazakhstan, USSR—April 19, 1985

· Benedict XVI, Cardinal Joseph Ratzinger, becomes the 265th pope—April 19, 2005

· Massive BP Petroleum oil spill in the Gulf of Mexico, began on April 20, 2010

The historical date of infamy for Israel and her enemies – April 20/21

This date has also had a dramatic impact on Israel and Jews. In the last 2,000 years, Jews have had many enemies and many antagonists; but three, in particular, stand out:

· Birth of Rome/Roman Empire

· Islam/Mohammad

· Nazi Germany/Hitler

What do they have in common? They were all born on April 20/21.

· The birth of Rome (by Romulus) is dated as April 21, 753 B.C.

· The birth of Mohammad is dated as April 20, 571 A.D.

· The birth of Adolph Hitler was April 20, 1889.

Additional:

· Israel faced the Great Arab Revolt of April 19, 1936.

· The birth of Iranian Supreme Leader Ali Khamenei on April 19, 1939.

· The Warsaw Ghetto Uprising began April 19, 1943.

· The ascension of Gamal Abdel Nasser in Egypt on April 18, 1954. Nasser was Israel’s lead antagonist for almost two decades. He was responsible for three wars with Israel from 1956–1970. He was also responsible for the first United Arab Republic—in 1958–1961, a concept that could reach a more cohesive realization in the coming years.

To say the least, this has been a very significant period of time for centuries.

The President's Working Group on Financial Markets

known colloquially as the Plunge Protection Team, or "(PPT)" was created by Executive Order 12631,[1] signed on March 18, 1988, by United States President Ronald Reagan.

As established by the executive order, the Working Group has three purposes and functions:

"(a) Recognizing the goals of enhancing the integrity, efficiency, orderliness, and competitiveness of our Nation's financial markets and maintaining investor confidence, the Working Group shall identify and consider:

(1) the major issues raised by the numerous studies on the events in the financial markets surrounding October 19, 1987, and any of those recommendations that have the potential to achieve the goals noted above; and

(2) the actions, including governmental actions under existing laws and regulations (such as policy coordination and contingency planning), that are appropriate to carry out these recommendations.

(b) The Working Group shall consult, as appropriate, with representatives of the various exchanges, clearinghouses, self-regulatory bodies, and with major market participants to determine private sector solutions wherever possible.

(c) The Working Group shall report to the President initially within 60 days (and periodically thereafter) on its progress and, if appropriate, its views on any recommended legislative changes."

Plunge Protection Team

"Plunge Protection Team" was originally the headline for an article in The Washington Post on February 23, 1997, and has since been used by some as an informal term to refer to the Working Group. Initially, the term was used to express the opinion that the Working Group was being used to prop up the stock markets during downturns.[5 Financial writers for British newspapers The Observer and The Daily Telegraph, along with U.S. Congressman Ron Paul, writers Kevin Phillips (who claims "no personal firsthand knowledge" and John Crudele,[8] have charged the Working Group with going beyond their legal mandate.[failed verification] Charles Biderman, head of TrimTabs Investment Research, which tracks money flow in the equities market, suspected that following the 2008 financial crisis the Federal Reserve or U.S. government was supporting the stock market. He stated that "If the money to boost stock prices did not come from the traditional players, it had to have come from somewhere else" and "Why not support the stock market as well? Moreover, several officials have suggested the government should support stock prices."

In August 2005, Sprott Asset Management released a report that argued that there is little doubt that the PPT intervened to protect the stock market.[10] However, these articles usually refer to the Working Group using moral suasion to attempt to convince banks to buy stock index futures.

Former Federal Reserve Board member Robert Heller, in the Wall Street Journal, opined that "Instead of flooding the entire economy with liquidity, and thereby increasing the danger of inflation, the Fed could support the stock market directly by buying market averages in the futures market, thereby stabilizing the market as a whole." Author Kevin Phillips wrote in his 2008 book Bad Money that while he had no interest "in becoming a conspiracy investigator", he nevertheless drew the conclusion that "some kind of high-level decision seems to have been reached in Washington to loosely institutionalize a rescue mechanism for the stock market akin to that pursued...to safeguard major U.S. banks from exposure to domestic and foreign loan and currency crises." Phillips infers that the simplest way for the Working Group to intervene in market plunges would be through buying stock market index futures contracts, either in cooperation with major banks or through trading desks at the U.S. Treasury or Federal Reserve.

What is the Plunge Protection Team?

(PPT) is an informal term for the Working Group on Financial Markets. The working group was created in 1988 by then U.S President Ronald Reagan following the infamous October 1987 Black Monday crash. It was formed to re-establish consumer confidence and take steps to achieve economic and market stability in the aftermath of the market crash. The U.S president consults with the team during times of economic uncertainty and turbulence in the markets.

The Working Group on Financial Markets’ informal name “Plunge Protection Team” was coined and popularized by The Washington Post in 1997.

What does the Plunge Protection Team Do?

The Plunge Protection Team was initially formed to advise the president and regulatory agencies on countering the negative impacts of the stock market crash of 1987. However, the team has continued to report to various presidents since that stock market crash and has met various U.S presidents on important financial matters over the years.

The team was believed to be behind the rally in the stock market shortly after a hefty drop in the Dow Jones Industrial Average (DJIA) on February 05, 2018. As per some market observers, after the plunge, the market made a smart recovery in the following days, which may have been a result of heavy buying by the Plunge Protection Team.

Who is on the plunge protection team?

The PPT several top government economic and financial officials. The Secretary of the Treasury heads the group, while the Chair of the Board of Governors of the Federal Reserve, the Chair of the Commodity Futures Trading Commission, and the Chair of the Securities and Exchange Commission, are also part of the team.

Why is the PPT secretive?

The Plunge Protection Team’s meetings or activities aren’t covered by the media, which gives rise to speculations and conspiracy theories about the team. The probable reason behind the secretive nature of its activities is that it reports only to the president. Some observers opine that the team’s role is not only limited to giving recommendations to the president; rather, the team intervenes in the market and artificially props up stock prices.

Critics claim that the members connive with big banks and profit from stock markets by carrying out trades on different stock exchanges when prices decline. They then artificially prop up the prices as part of their market stabilization efforts and profit from their transactions.

When does/have the PPT meet?

Although very little has come out in the mainstream media about the group’s activities, there have been some instances when the team’s meetings were reported. For example, in 1999, the team proposed to congress to incorporate some changes in the derivatives markets regulations. The last reported meeting of the group, at the time of this writing in June 2022, was in December 2018 when Treasury Secretary Steven Mnuchin headed the teleconference with the group’s members. Representatives from the Federal Deposit Insurance Corporation and the Comptroller of the Currency also attended the meeting.

Before the teleconference that took place on December 24, 2018, the S&P 500 and the DJIA had been under pressure for the whole month. But after Christmas, the DJIA and the S&P 500 both recovered and reversed most of the losses in the next few days. Conspiracy theorists attribute the recovery and gains in the indices to the intervention by the Plunge Protection Team.

Final Thoughts

The Working Group on Financial Markets serves an important function: to advise the president on financial markets and economic affairs. Because the exact nature of the group’s activities or recommendations haven't been made public, some critics of the group blame the group for market intervention and artificially propping up stocks’ prices. However, some market observers believe that the team’s quiet activities are excused as it reports directly to the president.

The Exchange Stabilization Fund protects the FED.

We already know the FED is lying that raising interest rates will reduce price inflation. The Exchange Stabilization Fund (ESF) is an emergency reserve account that can be used by the U.S. Department of Treasury to mitigate instability in various financial sectors, including credit, securities, and foreign exchange markets. The U.S. Exchange Stabilization Fund was established at the Treasury Department by a provision in the Gold Reserve Act of 1934.

https://en.wikipedia.org/wiki/

Gold market manipulation: Why, how, and how long? (2021 edition)

https://gata.org/node/20925

https://tinyurl.com/2rd9wv52

OPPORTUNITY TO ACCESS MARK LEIBOVIT'S PROPRIETARY VOLUME REVERSAL INDICATOR - THIS IS THE ONLY PLACE TO DO IT!

https://www.metastock.com/prod

COME ON, DAD. IT'S TIME TO EAT

DISCLAIMER:

WE ARE NOT FINANCIAL ADVISORS AND DO NOT PROVIDE FINANCIAL ADVICE

The website, LeibovitVRNewsletters.com, is published by LeibovitVRNewsletters LLC.

In using LeibovitVRnewsletters.com (a/k/a LeibovitVRNewsletters LLC) you agree to these Terms & Conditions governing the use of the service. These Terms & Conditions are subject to change without notice. We are publishers and are not registered as a broker-dealer or investment adviser either with the U.S. Securities and Exchange Commission or with any state securities authority.

All stocks and ETFs discussed are HYPOTHETICAL and not actual trades whose actual execution may differ markedly from prices posted on the website and in emails. This may be due internet connectivity, quote delays, data entry errors and other market conditions. Hypothetical or simulated performance results have certain inherent limitations as to liquidity and execution among other variables. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE FORECASTING ACCURACY OR PROFITABLE TRADING RESULTS.

All investments are subject to risk, which should be considered on an individual basis before making any investment decision. We are not responsible for errors and omissions. These publications are intended solely for information and educational purposes only and the content within is not to be construed, under any circumstances, as an offer to buy or to sell or a solicitation to buy or sell or trade in any commodities or securities named within.

All commentary is provided for educational purposes only. This material is based upon information we consider reliable. However, accuracy is not guaranteed. Subscribers should always do their own investigation before investing in any security. Furthermore, you cannot be assured that your will profit or that any losses can or will be limited. It is important to know that no guarantee of any kind is implied nor possible where projections of future conditions in the markets are attempted.

Stocks and ETFs may be held by principals of LeibovitVRNewsletters LLC whose personal investment decisions including entry and exit points may differ from guidelines posted.

LeibovitVRNewsletters.com cannot and do not assess, verify or guarantee the suitability or profitability of any particular investment. You bear responsibility for your own investment research and decisions and should seek the advice of a qualified securities professional before making any investment. As an express condition of using this service and anytime after ending the service, you agree not to hold LeibovitVRNewsletters.com or any employees liable for trading losses, lost profits or other damages resulting from your use of information on the Site in any form (Web-based, email-based, or downloadable software), and you agree to indemnify and hold LeibovitVRNewsletters.com and its employees harmless from and against any and all claims, losses, liabilities, costs, and expenses (including but not limited to attorneys' fees) arising from your violation of this agreement. This paragraph is not intended to limit rights available to you or to us that may be available under the federal securities laws.

For rights, permissions, subscription and customer service, contact the publisher at mark.vrtrader@gmail.com or call at 928-282-1275 or mail to 10632 N. Scottsdale Road B-426, Scottsdale, AZ 85254.

The Leibovit Volume Reversal, Volume Reversal and Leibovit VR are registered trademarks.

© Copyright 2024. All rights reserved.

MARK LEIBOVIT - LEIBOVIT VR NEWSLETTERS - FRIDAY - APRIL 19, 2024 - THE EXPANSION OF WORLD WAR III UNFOLDS AS THE TALKING HEADS ON WALL STREET ONLY THINK OF THE FED.

FOLKS THIS ALL YOU NEEDED TO KNOW!

HISTORICALLY A GOOD SIGN THAT WE ARE AT OR NEAR A MARKET TOP = BULLISH MEDIA HEADLINES LIKE THIS

DOW JONES DIA WEEKLY WITH LEIBOVIT NEGATIVE VOLUME REVERSAL DEFINING A TOP - REPEAT OF YESTERDAY'S CHART

BULL TRAP STILL UNDERWAY

ARE MORE BLACK SWANS ARE UNDERWAY ? - CAN YOU NAME THE ONES WE'VE JUST RECENTLY EXPERIENCED? CAN YOU GUESS WHAT IS COMING?

THE VR FORECASTER - ANNUAL FORECAST MODEL

ORDER TODAY AND WE WILL MANUALLY EMAIL YOU THE REPORT BEFORE IT IS POSTED ON THE WEBSITE

HERE IS THE 2023 ANNUAL FORECAST MODEL WITH THE 'RESULTS' SUPERIMPOSED

HERE IS THE 2023 ANNUAL FORECAST MODEL FOR BITCOIN WITH THE 'RESULTS' SUPERIMPOSED

ORDER PAGE

http://tinyurl.com/5f7wb6zs

https://www.howestreet.com/2024/04/stock-markets-appear-to-be-in-correction-territory-mark-leibovit/

Nasdaq, S&P 500 Extend Losing Streaks To Five Days - BUT THE SIXTH DAY IS COMING WITH THE POST MARKET NEWS ISRAEL/IRAN

After once again failing to sustain an early upward move, stocks came under pressure over the course of the trading session on Thursday. The major averages pulled back well off their highs of the session, with the Nasdaq and the S&P 500 ending the day in negative territory.

Reflecting weakness in the tech sector, the Nasdaq slid 81.87 points or 0.5 percent to 15,601.50, while the S&P 500 dipped 11.09 points or 0.2 percent to 5,011.12. The narrower Dow bucked the downtrend, inching up 22.07 points or 0.1 percent to 37,775.38

With the downturn on the day, the Nasdaq and the S&P 500 extended their losing streaks to five days, falling to their lowest closing levels in almost two months.

The early strength on Wall Street partly reflected bargain hunting, as traders looked to pick up stocks at relatively reduced levels following recent weakness.

However, as with other recent rebound attempts, buying interest waned over the course of the session amid ongoing concerns about the outlook for interest rates.

Potentially adding to the interest rate worries, the Philadelphia Federal Reserve released a report showing a considerable acceleration in the pace of growth in regional manufacturing activity in the month of April.

The Philly Fed said its diffusion index for current general activity jumped to 15.5 in April from 3.2 in March, with a positive reading indicating growth. Economists had expected the index to edge down to 1.5.

Notably, the report also said the prices paid index surged to 23.0 in April from 3.7 in May, reaching its highest reading since December 2023.

Quincy Krosby, Chief Global Strategist for LPL Financial, said the spike by the prices paid index supports "the Fed's concerns regarding inflationary pressures stalling in its downward trajectory."

The Labor Department also released a report showing first-time claims for U.S. unemployment benefits remained flat in the week ended April 13th.

The report said initial jobless claims came in at 212,000, unchanged from the previous week's revised level. Economists had expected jobless claims to rise to 215,000 from the 211,000 originally reported for the previous week.

"Jobless claims remain well below levels that would signal a major slowdown in job growth," said Nancy Vanden Houten, Lead U.S. Economist at Oxford Economics.

She added, "A strong labor market gives the Federal Reserve the room to put off rate cuts until inflation gets back on a sustainable path to 2%."

Meanwhile, the National Association of Realtors released a report showing a sharp pullback by existing home sales in the U.S. in the month March.

NAR said existing home sales plunged by 4.3 percent to an annual rate of 4.19 million in March after surging by 9.5 percent to a rate of 4.38 million in February. Economists had expected existing home sales to slump to a rate of 4.20 million.

Semiconductor stocks came under pressure over the course of the session, dragging the Philadelphia Semiconductor Index down by 1.7 percent to its lowest closing level in almost two months.

U.S.-listed shares of Taiwan Semiconductor Manufacturing (TSM) have tumbled by 4.9 percent even though the chipmaker reported better than expected first quarter results.

Considerable weakness also emerged among biotechnology stocks, with the NYSE Arca Biotechnology Index falling by 1.6 percent to its lowest closing level in well over four months.

Software, computer hardware and oil producer stocks also moved to the downside on the day, while significant strength remained visible among airline stocks.

Alaska Air (ALK) soared by 4.0 percent after reporting a narrower than expected first quarter loss on revenues that exceeded analyst estimates.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region moved mostly higher on Thursday. China's Shanghai Composite Index inched up by 0.1 percent and Japan's Nikkei 225 Index rose by 0.3 percent, while South Korea's Kospi surged by 2.0 percent.

The major European markets also moved to the upside on the day. While the French CAC 40 Index climbed by 0.5 percent, the U.K.'s FTSE 100 Index and the German DAX Index both rose by 0.4 percent.

In the bond market, treasuries once again came under pressure following the rebound seen in the previous session. Subsequently, the yield on the benchmark ten-year note, which moves opposite of its price, jumped 6.2 basis points to 4.647 percent

Looking Ahead

Amid a lack of major U.S. economic news, the reaction to the latest corporate earnings news may drive trading on Friday.

Streaming giant Netflix (NFLX) is among the companies releasing their quarterly results after the close of today's trading, while credit card giant America Express (AXP) is among the companies due to report their results before the start of trading on Friday.

The stock market is headed for a hard 'reset' that could take years to recover from, CIO says -Business Insider

by Jennifer Sor

chartStocks have been in the midst of a long bull market, but there are signs that it's finally going to run out of steam and will inevitably be followed by a bear market and a difficult "reset," according to Chris Vermeulen,CIO of Technical Traders.

In an interview with Bloomberg, the investment chief pointed to the recent run-up in defensive assets, like precious metals, energy stocks, and industrial stocks. Those areas all typically do well in the late stage of a bull market, which is inevitably followed by a bear market or a "financial reset," Vermeulen said.

Investors are likely heading into another bear market, similar to the ones that followed the dot-com bubble and the 2008 financial crisis, he predicted. That could end up sparking painful stock losses for investors, with people seeing their wealth decline as much as 30%-50% over the next year, he warned.

"I think we're coming into a major market top, more or less a financial reset," Vermeulen said Tuesday. "It's short-term, temporarily painful. But we need markets to reset. We need regular pullbacks and corrections in order for the market to keep going up."

That reset could also come with a recession, Vermeulen said, with industrial stocks in particular signaling a slowdown for the economy. While the sector has done well in recent months, buyers of industrial goods typically upgrade their equipment at the end of an economic growth cycle, due to "huge delays" between slowing business and orders for new machinery.

"They don't realize we're coming to the end of a growth cycle, and the music is about to stop," Vermeulen said of US firms. "Industrial stocks have just continued to muscle their way higher. They're hitting all-time highs, and that is a sign that we're going to see these companies eventually start to slow down."

BRICS: JP Morgan Issues Major US Financial Warning -Watcher.Guru

by Vinod Dsouza

Leading investment bank JP Morgan has issued a major financial warning that could affect the US economy this year. The CEO Jamie Dimon told investors on Monday that he believes the US economy will be affected by forces from outside of America. The JP Morgan CEO explained that he worries about geopolitical events including the Russia-Ukraine war, the Israel-Palestine conflict, and the BRICS de-dollarization agenda to create an economic risk on the US markets.

“These significant and somewhat unprecedented forces cause us to remain cautious,” said JP Morgan CEO Dimon.

Dimon stressed that America’s global leadership is being challenged by developing countries including the SCO bloc, ASEAN group, and BRICS. The CEO of JP Morgan said that while BRICS and other countries are looking to uproot the US dollar, the polarized electorate in America is causing further division. He called the development a “great crisis” that threatens free Western enterprises.

The comments from Dimon were made in the Annual Shareholder Letter this year. “America’s global leadership role is being challenged outside by other nations and inside by our polarized electorate,” he said. The JP Morgan head hinted that BRICS will not be the only alliance that kick-starts the de-dollarization agenda. He urged that the US must put aside all differences and work closely with developing countries.

The President's Working Group on Financial Markets

known colloquially as the Plunge Protection Team, or "(PPT)" was created by Executive Order 12631,[1] signed on March 18, 1988, by United States President Ronald Reagan.

As established by the executive order, the Working Group has three purposes and functions:

"(a) Recognizing the goals of enhancing the integrity, efficiency, orderliness, and competitiveness of our Nation's financial markets and maintaining investor confidence, the Working Group shall identify and consider:

(1) the major issues raised by the numerous studies on the events in the financial markets surrounding October 19, 1987, and any of those recommendations that have the potential to achieve the goals noted above; and

(2) the actions, including governmental actions under existing laws and regulations (such as policy coordination and contingency planning), that are appropriate to carry out these recommendations.

(b) The Working Group shall consult, as appropriate, with representatives of the various exchanges, clearinghouses, self-regulatory bodies, and with major market participants to determine private sector solutions wherever possible.

(c) The Working Group shall report to the President initially within 60 days (and periodically thereafter) on its progress and, if appropriate, its views on any recommended legislative changes."

Plunge Protection Team

"Plunge Protection Team" was originally the headline for an article in The Washington Post on February 23, 1997, and has since been used by some as an informal term to refer to the Working Group. Initially, the term was used to express the opinion that the Working Group was being used to prop up the stock markets during downturns.[5 Financial writers for British newspapers The Observer and The Daily Telegraph, along with U.S. Congressman Ron Paul, writers Kevin Phillips (who claims "no personal firsthand knowledge" and John Crudele,[8] have charged the Working Group with going beyond their legal mandate.[failed verification] Charles Biderman, head of TrimTabs Investment Research, which tracks money flow in the equities market, suspected that following the 2008 financial crisis the Federal Reserve or U.S. government was supporting the stock market. He stated that "If the money to boost stock prices did not come from the traditional players, it had to have come from somewhere else" and "Why not support the stock market as well? Moreover, several officials have suggested the government should support stock prices."

In August 2005, Sprott Asset Management released a report that argued that there is little doubt that the PPT intervened to protect the stock market.[10] However, these articles usually refer to the Working Group using moral suasion to attempt to convince banks to buy stock index futures.

Former Federal Reserve Board member Robert Heller, in the Wall Street Journal, opined that "Instead of flooding the entire economy with liquidity, and thereby increasing the danger of inflation, the Fed could support the stock market directly by buying market averages in the futures market, thereby stabilizing the market as a whole." Author Kevin Phillips wrote in his 2008 book Bad Money that while he had no interest "in becoming a conspiracy investigator", he nevertheless drew the conclusion that "some kind of high-level decision seems to have been reached in Washington to loosely institutionalize a rescue mechanism for the stock market akin to that pursued...to safeguard major U.S. banks from exposure to domestic and foreign loan and currency crises." Phillips infers that the simplest way for the Working Group to intervene in market plunges would be through buying stock market index futures contracts, either in cooperation with major banks or through trading desks at the U.S. Treasury or Federal Reserve.

What is the Plunge Protection Team?

(PPT) is an informal term for the Working Group on Financial Markets. The working group was created in 1988 by then U.S President Ronald Reagan following the infamous October 1987 Black Monday crash. It was formed to re-establish consumer confidence and take steps to achieve economic and market stability in the aftermath of the market crash. The U.S president consults with the team during times of economic uncertainty and turbulence in the markets.

The Working Group on Financial Markets’ informal name “Plunge Protection Team” was coined and popularized by The Washington Post in 1997.

What does the Plunge Protection Team Do?

The Plunge Protection Team was initially formed to advise the president and regulatory agencies on countering the negative impacts of the stock market crash of 1987. However, the team has continued to report to various presidents since that stock market crash and has met various U.S presidents on important financial matters over the years.

The team was believed to be behind the rally in the stock market shortly after a hefty drop in the Dow Jones Industrial Average (DJIA) on February 05, 2018. As per some market observers, after the plunge, the market made a smart recovery in the following days, which may have been a result of heavy buying by the Plunge Protection Team.

Who is on the plunge protection team?

The PPT several top government economic and financial officials. The Secretary of the Treasury heads the group, while the Chair of the Board of Governors of the Federal Reserve, the Chair of the Commodity Futures Trading Commission, and the Chair of the Securities and Exchange Commission, are also part of the team.

Why is the PPT secretive?

The Plunge Protection Team’s meetings or activities aren’t covered by the media, which gives rise to speculations and conspiracy theories about the team. The probable reason behind the secretive nature of its activities is that it reports only to the president. Some observers opine that the team’s role is not only limited to giving recommendations to the president; rather, the team intervenes in the market and artificially props up stock prices.

Critics claim that the members connive with big banks and profit from stock markets by carrying out trades on different stock exchanges when prices decline. They then artificially prop up the prices as part of their market stabilization efforts and profit from their transactions.

When does/have the PPT meet?

Although very little has come out in the mainstream media about the group’s activities, there have been some instances when the team’s meetings were reported. For example, in 1999, the team proposed to congress to incorporate some changes in the derivatives markets regulations. The last reported meeting of the group, at the time of this writing in June 2022, was in December 2018 when Treasury Secretary Steven Mnuchin headed the teleconference with the group’s members. Representatives from the Federal Deposit Insurance Corporation and the Comptroller of the Currency also attended the meeting.

Before the teleconference that took place on December 24, 2018, the S&P 500 and the DJIA had been under pressure for the whole month. But after Christmas, the DJIA and the S&P 500 both recovered and reversed most of the losses in the next few days. Conspiracy theorists attribute the recovery and gains in the indices to the intervention by the Plunge Protection Team.

Final Thoughts

The Working Group on Financial Markets serves an important function: to advise the president on financial markets and economic affairs. Because the exact nature of the group’s activities or recommendations haven't been made public, some critics of the group blame the group for market intervention and artificially propping up stocks’ prices. However, some market observers believe that the team’s quiet activities are excused as it reports directly to the president.

The Exchange Stabilization Fund protects the FED.

We already know the FED is lying that raising interest rates will reduce price inflation. The Exchange Stabilization Fund (ESF) is an emergency reserve account that can be used by the U.S. Department of Treasury to mitigate instability in various financial sectors, including credit, securities, and foreign exchange markets. The U.S. Exchange Stabilization Fund was established at the Treasury Department by a provision in the Gold Reserve Act of 1934.

https://en.wikipedia.org/wiki/

Gold market manipulation: Why, how, and how long? (2021 edition)

https://gata.org/node/20925

https://tinyurl.com/2rd9wv52

OPPORTUNITY TO ACCESS MARK LEIBOVIT'S PROPRIETARY VOLUME REVERSAL INDICATOR - THIS IS THE ONLY PLACE TO DO IT!

https://www.metastock.com/prod

COME ON, DAD. IT'S TIME TO EAT

DISCLAIMER:

WE ARE NOT FINANCIAL ADVISORS AND DO NOT PROVIDE FINANCIAL ADVICE

The website, LeibovitVRNewsletters.com, is published by LeibovitVRNewsletters LLC.

In using LeibovitVRnewsletters.com (a/k/a LeibovitVRNewsletters LLC) you agree to these Terms & Conditions governing the use of the service. These Terms & Conditions are subject to change without notice. We are publishers and are not registered as a broker-dealer or investment adviser either with the U.S. Securities and Exchange Commission or with any state securities authority.

All stocks and ETFs discussed are HYPOTHETICAL and not actual trades whose actual execution may differ markedly from prices posted on the website and in emails. This may be due internet connectivity, quote delays, data entry errors and other market conditions. Hypothetical or simulated performance results have certain inherent limitations as to liquidity and execution among other variables. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE FORECASTING ACCURACY OR PROFITABLE TRADING RESULTS.

All investments are subject to risk, which should be considered on an individual basis before making any investment decision. We are not responsible for errors and omissions. These publications are intended solely for information and educational purposes only and the content within is not to be construed, under any circumstances, as an offer to buy or to sell or a solicitation to buy or sell or trade in any commodities or securities named within.

All commentary is provided for educational purposes only. This material is based upon information we consider reliable. However, accuracy is not guaranteed. Subscribers should always do their own investigation before investing in any security. Furthermore, you cannot be assured that your will profit or that any losses can or will be limited. It is important to know that no guarantee of any kind is implied nor possible where projections of future conditions in the markets are attempted.

Stocks and ETFs may be held by principals of LeibovitVRNewsletters LLC whose personal investment decisions including entry and exit points may differ from guidelines posted.

LeibovitVRNewsletters.com cannot and do not assess, verify or guarantee the suitability or profitability of any particular investment. You bear responsibility for your own investment research and decisions and should seek the advice of a qualified securities professional before making any investment. As an express condition of using this service and anytime after ending the service, you agree not to hold LeibovitVRNewsletters.com or any employees liable for trading losses, lost profits or other damages resulting from your use of information on the Site in any form (Web-based, email-based, or downloadable software), and you agree to indemnify and hold LeibovitVRNewsletters.com and its employees harmless from and against any and all claims, losses, liabilities, costs, and expenses (including but not limited to attorneys' fees) arising from your violation of this agreement. This paragraph is not intended to limit rights available to you or to us that may be available under the federal securities laws.

For rights, permissions, subscription and customer service, contact the publisher at mark.vrtrader@gmail.com or call at 928-282-1275 or mail to 10632 N. Scottsdale Road B-426, Scottsdale, AZ 85254.

The Leibovit Volume Reversal, Volume Reversal and Leibovit VR are registered trademarks.

© Copyright 2024. All rights reserved.